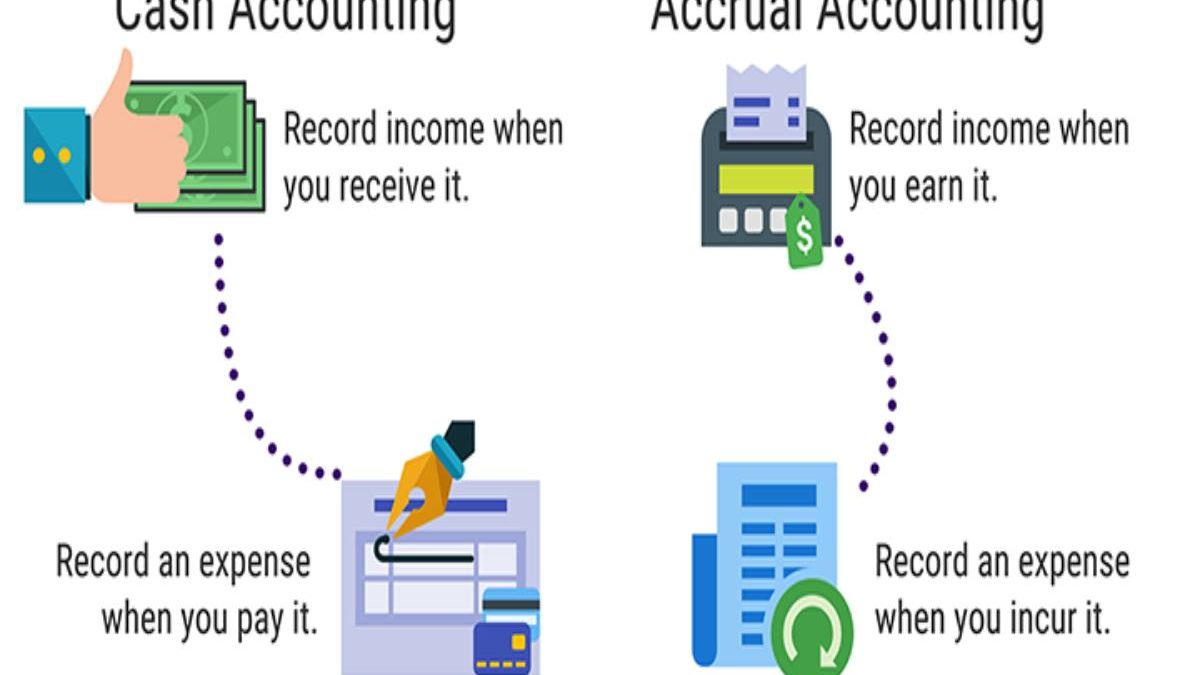

The differences between cash and accrual accounting lie in the timing of when sales and purchase records in our accounts.

And cash accounting recognizes revenue and expenses only when money changes hands.

But accrual accounting recognizes revenue when earned and expenses when they billed but not paid.

Also,You can find more helpful resources at inbusinesswolrd.com

Table of Contents

What is the basis of Cash Accounting?

- The basis cash of accounting recognizes revenues when money receives, and expenses when they compensate. Its method does not recognize accounts receivable and accounts payable.

- And many small businesses opt to use the actual cash of accounting because it’s simple to maintain.

- It’s easy to determine when the transaction occurs (the money in the bank and out of the bank. And here no need to track receivables and payables.

- The cash methods were also beneficial in tracking how much cash the business takes at any given time. We look at our bank balance and understand the exact resources at our disposal.

- Also, since transactions, not records until the cash receives and paid, the business’s income isn’t taxed until it’s in the bank.

What is the basis of Accrual Accounting?

- Accrual accounting method of accounting wherever revenues and expenses it recorded when it earns.

- Also, it regardless of when the money receives and paid. For example, you would record revenue when a project is complete.

- And rather than when we get paid. It method extra commonly used than the cash method.

- The upside that the accrual basis gives the extra realistic idea of income and expenses during the period.

- And therefore, it provides the long-term picture of the business that cash accounting can’t offer.

- And the downside that accrual accounting doesn’t provide any awareness of cash flow. The business appears very profitable.

- While in reality, it takes empty bank accounts. And accrual basis accounting without careful monitoring of cash flow takes potentially devastating consequences.

What does it mean to Record Transactions?

- We talk a lot so far about recording transactions in our books and how cash and accrual dictate when we do that. But what does it mean to record the transaction?

- Every business takes to record all its financial transactions in the ledger—otherwise known as bookkeeping.

- We need to do this if we want to claim tax deductions at the end of the year. And we need one central place to add up all our income and expenses (we need this info to file our taxes).

- There are some excellent DIY bookkeeping options out there. And if we did instead take someone else to do our bookkeeping for us.

In addition, you can read more helpful posts at marketingmediaweb